GTMRS is currently listed against BUSD on the Binance DEX Secondary Board-BEP8 miniToken segment. Transaction fee payable in BNB.

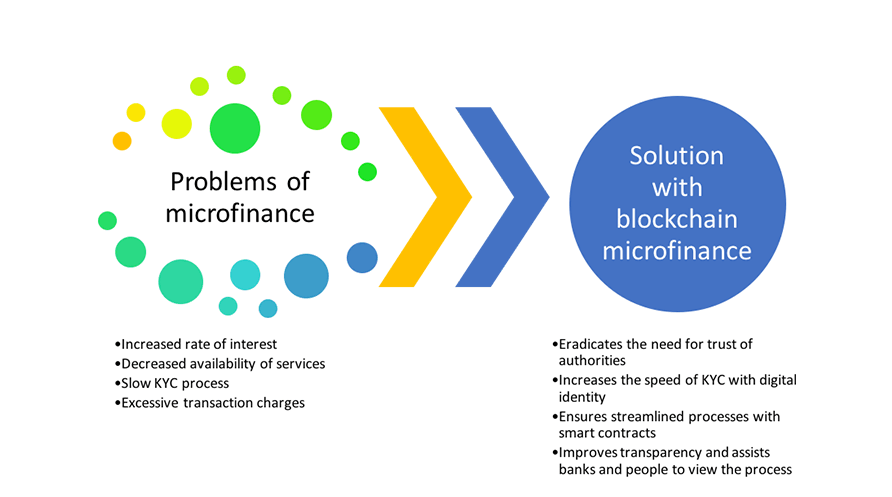

The Binance Dex Secondary Board marks a major milestone in the enhancement of Binance Chain to accommodate the small or micro projects, microfinancing, intellectual properties, and other small token economies to build a more comprehensive venue for token trading.

Think of the Binance Dex Secondary Board as something similar to the Small and Medium Enterprise (SME) boards in traditional stock markets.

GTMRS token is designed to get elevated and traded on the Binance DEX Main Board when it gets enough liquidity and maturity.